In the latest Local 20/20 column in the Port Townsend Leader, Cyndy Bratz summarizes how the Inflation Reduction Act can save you money and reduce your carbon footprint at the same time.

by Cyndy Bratz

What if you could reduce your carbon footprint and save money at the same time? The Inflation Reduction Act (IRA), the biggest climate bill in US history, will help many Americans reduce their home energy costs and go electric. The High-Efficiency Electric Home Rebate Act (HEEHRA) was included in the IRA of 2022.

Take your time and check it out. The rebates will start in 2023, after state-run programs are developed. Here are steps to help you maximize savings when it’s time to buy:

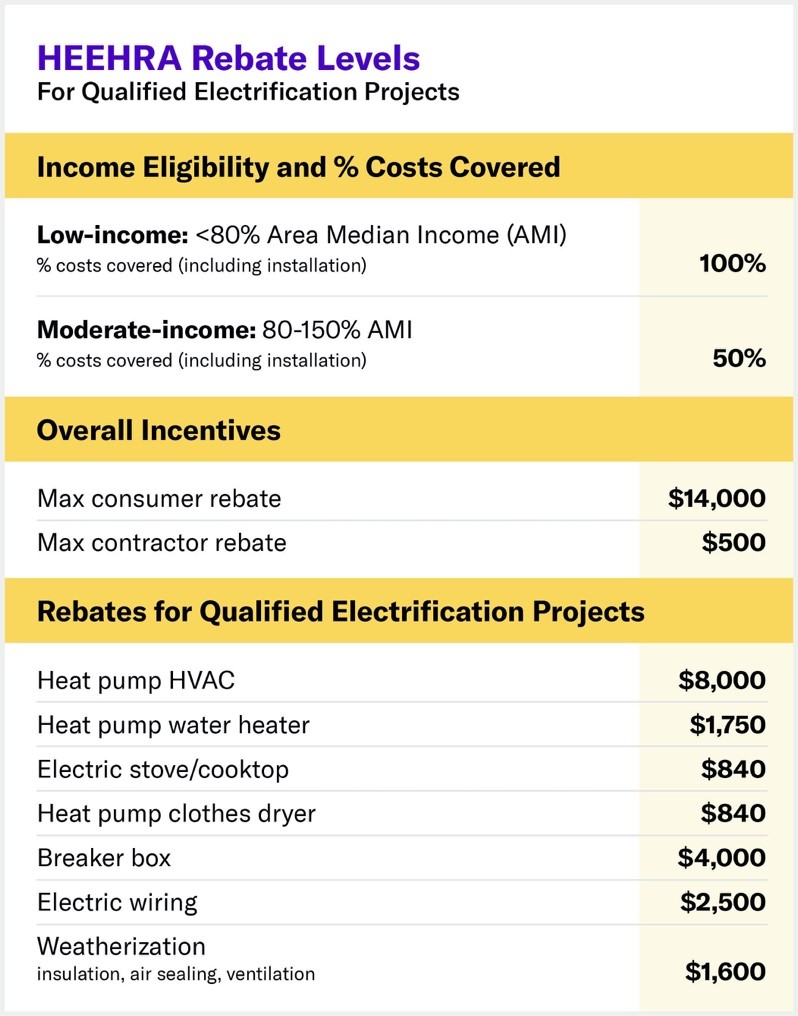

Determine your eligibility for rebates. The HEEHRA Program was designed to make switching from gas to electric more economical for many people, including those who can least afford it.

For Jefferson County, the current AMI (from the Area Median Income Lookup Tool) is $79,600, so those earning <$63,680 (in 2022 dollars) are potentially eligible to have 100% of their costs covered, although rebates are capped at specific dollar amounts. (The AMI may be adjusted in 2023, when this program starts.)

Rewiring America, a nonprofit research and policy group focused on energy efficiency, shows funding available and how you qualify: rewiringamerica.org/app/ira-calculator.

Wait until the Washington State Energy Office has implemented the program, which may be mid- to late-2023. Although the federal Department of Energy leads the programs, each state will have its own version.

Research additional financial programs. If you’re not eligible for the HEEHRA rebates, or if our state program doesn’t cover what you want or need, you have alternatives. You could quality for new IRA tax credits under the Energy Efficient Home Improvement credit (tax form 25C). You may be able to deduct up to 30% of the cost for work on your breaker box (up to $1,200). The HEEHRA rebates can only be used once per appliance for eligible households. But the 25C tax credits are available to most people and can be applied every year from 2023 until they expire in 2032. Tax credits can even be applied to the remaining costs after the HEEHRA rebate is deducted.

You may also qualify for other rebates from HEEHRA, from your electric utility, city or state – the HEEHRA rebates and IRA tax credits can be layered with these alternative programs. Experts recommend checking the DSIRE website (Database for State Incentives for Renewables and Efficiency) occasionally before you buy. You might also talk to your accountant for information on the tax benefits of various rebate/tax credit approaches. If you do your own taxes, does your tax software include current information on this new program?

Audit your appliances.

As you research rebates and tax credits – and wait for them to kick in – take a look at your kitchen and laundry room appliances to see what needs to be upgraded first. Ask yourself how old your appliances are? Are they gas or electric? How well are they working for you? Make a priority list of what to replace first.

Do you need to replace your home heating system with a heat pump? The rebate is up to $8,000. In addition, find out what other work you might need to do to prepare to go electric. In addition to the $840 off the cost of an electric or induction range or cooktop, or an electric heat-pump clothes dryer, the rebates cover up to $1,600 for weatherization; up to $2,500 for upgrades to your electric wiring; and up to $4,000 for upgrading your breaker box.

Keep an eye on Rewiring America’s website rewiringamerica.org/policy/high-efficiency-electric-home-rebate-act and keep checking dsireusa.org for information on when Washington State Incentives for Renewables and Efficiency have kicked in for the HEEHRA program.

Cynthia Bratz is a retired environmental engineer with expertise in clean water, sustainability and climate change. She is a member of the Local 20/20 Climate group.